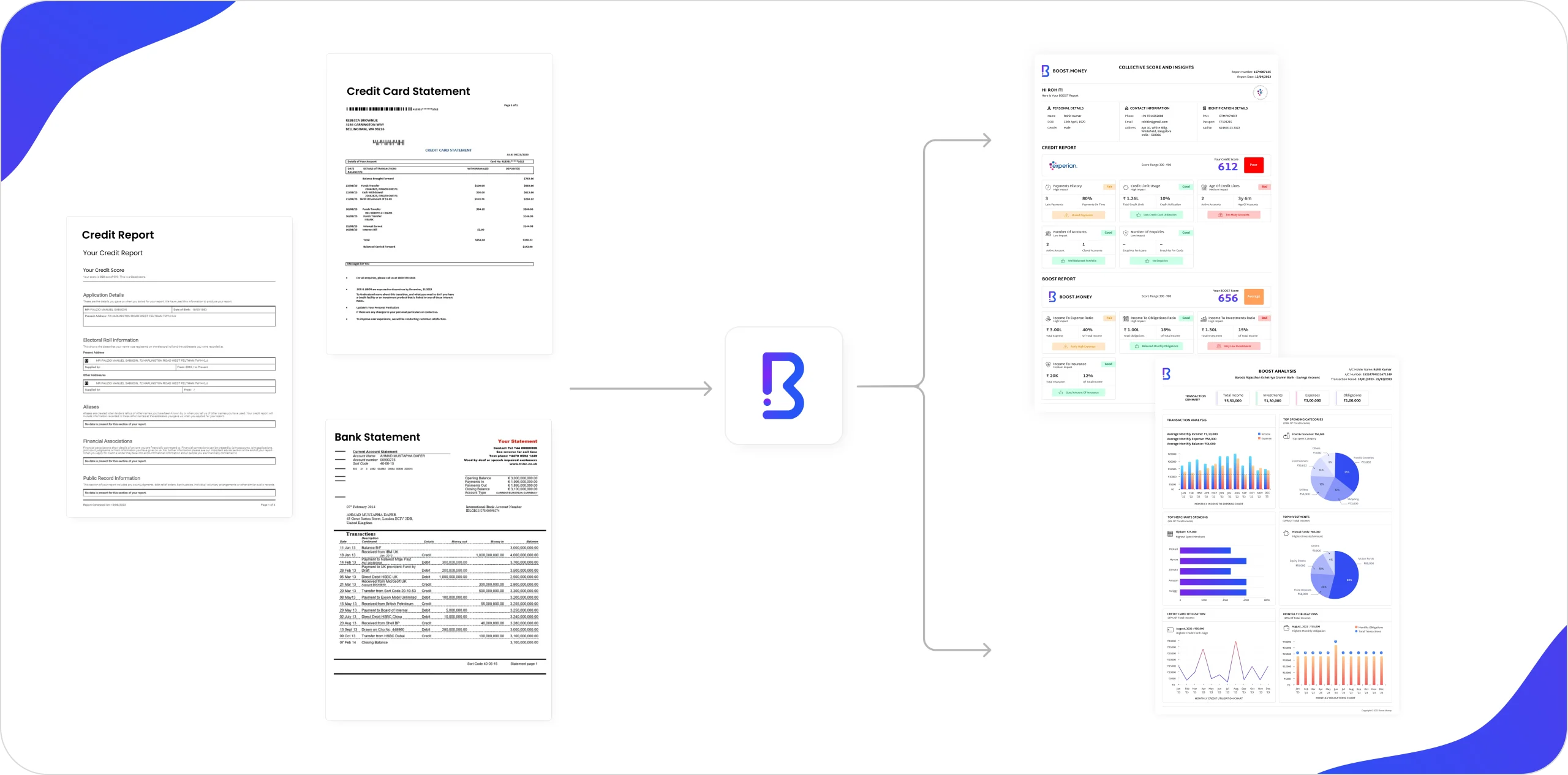

Outdated Data

Traditional credit reports are updated infrequently, often missing recent changes in income, expenses, or new financial obligations that affect creditworthiness.

No Cash Flow View

They don't provide insights into a borrower’s income, spending habits, or monthly obligations, making it hard to assess real repayment capacity.

No Fraud Detection

Without access to actual transaction data, traditional reports can't detect suspicious patterns like irregular salary deposits or fabricated financial activity.

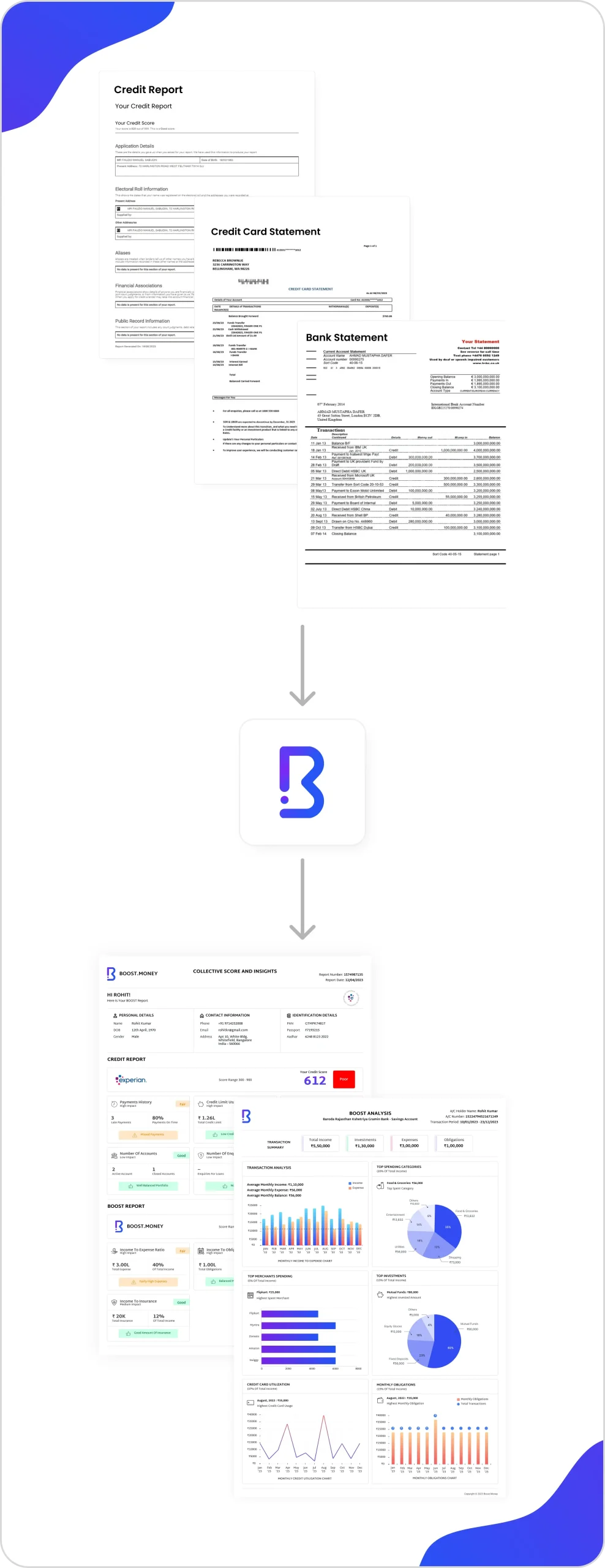

Outdated Data

Traditional credit reports are updated infrequently, often missing recent changes in income, expenses, or new financial obligations that affect creditworthiness.

No Cash Flow View

They don't provide insights into a borrower’s income, spending habits, or monthly obligations, making it hard to assess real repayment capacity.

No Fraud Detection

Without access to actual transaction data, traditional reports can't detect suspicious patterns like irregular salary deposits or fabricated financial activity.